Price Forecasting Models For Sana Biotechnology Inc Sana Stock

5 out of 5

| Language | : | English |

| File size | : | 3543 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 58 pages |

| Lending | : | Enabled |

Sana Biotechnology Inc. is a clinical-stage biotechnology company developing engineered cell therapies for the treatment of cancer and other serious diseases. The company's stock has been volatile in recent months, and investors are keen to know what the future holds for SANA stock. In this article, we will discuss the different price forecasting models that can be used to predict the future price of SANA stock.

Technical Analysis

Technical analysis is a method of forecasting future stock prices by studying past price data. Technical analysts believe that the price of a stock will move in predictable patterns, and they use charts and other tools to identify these patterns. There are many different technical analysis indicators, but some of the most common include:

- Moving averages

- Support and resistance levels

- Trendlines

- Candlestick patterns

Technical analysts can use these indicators to identify potential trading opportunities. For example, a technical analyst might buy a stock when it breaks above a resistance level, or they might sell a stock when it falls below a support level. However, it is important to remember that technical analysis is not an exact science, and it is not always possible to predict future stock prices with certainty.

Fundamental Analysis

Fundamental analysis is a method of forecasting future stock prices by studying the company's financial statements and other fundamental data. Fundamental analysts believe that the price of a stock is ultimately determined by the company's earnings and other financial metrics. Some of the most important financial metrics used in fundamental analysis include:

- Revenue

- Earnings per share

- Price-to-earnings ratio

- Debt-to-equity ratio

Fundamental analysts can use these metrics to assess a company's financial health and prospects. For example, a fundamental analyst might buy a stock if the company has a history of strong earnings growth and a low debt-to-equity ratio. However, it is important to remember that fundamental analysis is not an exact science, and it is not always possible to predict future stock prices with certainty.

Quantitative Analysis

Quantitative analysis is a method of forecasting future stock prices using mathematical models. Quantitative analysts use historical data to build statistical models that can predict future stock prices. There are many different quantitative analysis models, but some of the most common include:

- Regression analysis

- Time series analysis

- Machine learning

Quantitative analysts can use these models to identify trading opportunities and to develop investment strategies. However, it is important to remember that quantitative analysis is not an exact science, and it is not always possible to predict future stock prices with certainty.

Which Price Forecasting Model Is Right For You?

There is no one-size-fits-all answer to this question. The best price forecasting model for you will depend on your individual investment goals and risk tolerance. If you are looking for a short-term trading strategy, then technical analysis may be a good option for you. If you are looking for a long-term investment strategy, then fundamental analysis may be a better option for you. And if you are looking for a more sophisticated approach to price forecasting, then quantitative analysis may be a good option for you.

No matter which price forecasting model you choose, it is important to remember that all models are imperfect. It is not possible to predict future stock prices with certainty. However, by using a price forecasting model, you can increase your chances of making informed investment decisions.

5 out of 5

| Language | : | English |

| File size | : | 3543 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 58 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Paperback

Paperback Magazine

Magazine Sentence

Sentence Bookmark

Bookmark Glossary

Glossary Bibliography

Bibliography Preface

Preface Manuscript

Manuscript Scroll

Scroll Codex

Codex Bestseller

Bestseller Biography

Biography Autobiography

Autobiography Memoir

Memoir Dictionary

Dictionary Resolution

Resolution Catalog

Catalog Card Catalog

Card Catalog Borrowing

Borrowing Stacks

Stacks Periodicals

Periodicals Study

Study Research

Research Scholarly

Scholarly Journals

Journals Reading Room

Reading Room Literacy

Literacy Thesis

Thesis Storytelling

Storytelling Awards

Awards Reading List

Reading List Book Club

Book Club S C Kate

S C Kate Baby Professor

Baby Professor Donna M Sudak

Donna M Sudak David Marcus

David Marcus Katerina Nikolas

Katerina Nikolas Alli Frank

Alli Frank Joe Burns

Joe Burns Anne Moss Rogers

Anne Moss Rogers Diane Stanley

Diane Stanley Charisse Jones

Charisse Jones Glen Segell

Glen Segell Shayne Daku

Shayne Daku James Hamilton Paterson

James Hamilton Paterson Lilly Jones

Lilly Jones Justin Pearson

Justin Pearson Illustrated Edition Kindle Edition

Illustrated Edition Kindle Edition Robert L Maginnis

Robert L Maginnis Maggie Smith

Maggie Smith Elizabeth L Wollman

Elizabeth L Wollman Nicholas Hill

Nicholas Hill

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Roald DahlNarrative Of Some Of The Lord's Dealings With George Llerwritten By Himself,...

Roald DahlNarrative Of Some Of The Lord's Dealings With George Llerwritten By Himself,...

Herb SimmonsEncanto For Cello Instrumental Play Along: A Journey into the Heart of Music...

Herb SimmonsEncanto For Cello Instrumental Play Along: A Journey into the Heart of Music...

John UpdikeConversations in Black on Power, Politics, and Leadership: Shaping the Future...

John UpdikeConversations in Black on Power, Politics, and Leadership: Shaping the Future... Jack PowellFollow ·18.4k

Jack PowellFollow ·18.4k Camden MitchellFollow ·3.1k

Camden MitchellFollow ·3.1k Robert FrostFollow ·8.2k

Robert FrostFollow ·8.2k Levi PowellFollow ·17.7k

Levi PowellFollow ·17.7k Harrison BlairFollow ·9.9k

Harrison BlairFollow ·9.9k Holden BellFollow ·15.5k

Holden BellFollow ·15.5k William PowellFollow ·7.8k

William PowellFollow ·7.8k Henry Wadsworth LongfellowFollow ·12.6k

Henry Wadsworth LongfellowFollow ·12.6k

Ken Follett

Ken FollettThe Double Lives of Black Women in America: Navigating...

Black women in...

Cade Simmons

Cade SimmonsBanging My Billionaire Boss: A Love Story for the Ages...

Chapter 1: The Interview I was...

Brent Foster

Brent FosterThe Struggle for Black Enfranchisement: A Complex and...

The struggle for...

Henry Green

Henry GreenWhen Savage Needs Love: His BBW Obsession

When Savage Needs Love is a 2019 romantic...

Alexandre Dumas

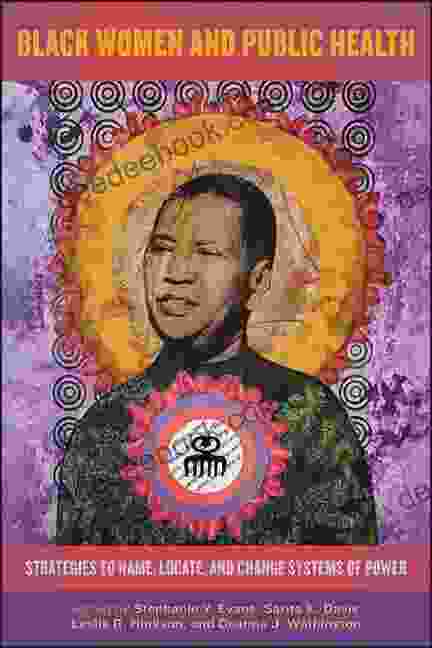

Alexandre DumasBlack Women and Public Health: A Historical Examination...

Black women have...

5 out of 5

| Language | : | English |

| File size | : | 3543 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 58 pages |

| Lending | : | Enabled |